Subsidies for wind and solar are here to stay

Par proteos le 13 avril 2014, 17:47 - Énergie - Lien permanent

Note: this post is an english summary of two posts in french (here and here).

It is often said that subsidies granted to wind and solar power are temporary and are here to help them become competitive with respect to other sources of electricity. Here, based on what happens currently on the electricity market in Germany and France, I will show that the removal of subsidies for new wind or solar capacity is unlikely and that it is probable that these subsidies will become a very long lasting feature of the electricity market in Europe.

A common characteristic of both wind and solar power is that their marginal cost is zero. Producing one more kWh does not cost anything to the owner. He has paid for his machine and pays for the maintenance, regardless of how much the machine produces. Their production is also essentially random — especially that of wind — and subject to the vagaries of the weather. Producer are also dispersed because the cost of building a single machine is not extraordinarily high. These 3 elements will transform producers of wind and solar power into price takers: they will accept any positive price, or even negative prices if they can't disconnect from the grid. Nowadays, they are shielded from the variations of the spot price by the feed-in tariffs which guarantee a fixed price for their production. A system of market premiums do not change that much the situation, as this would only encourage disconnections when the price drops too far in negative territory.

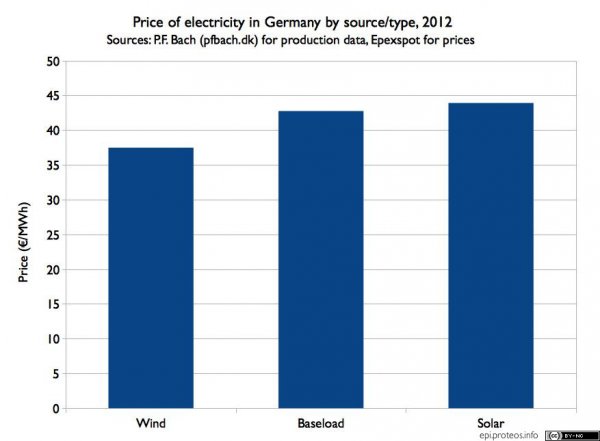

As a consequence, one can expect that wind would fetch a price lower than the baseload price — the non weighted average of all hourly prices in a given year. for solar power, the situation is slightly different because solar power is available during the day, where consumption is also higher than during the night. The price of electricity is thus generally higher during the day than during the night. But if the solar capacity is large enough — larger than night-day swing in demand — they will also fetch a lower price than the baseload.

To check these hypotheses, I gathered prices on Epexspot with a perl script. For France, one can get detailed production data from éco₂mix. For Germany, there's nothing so detailed … and free at the same time. Wind and solar productions are known thanks to an european directive. The data has been gathered by P.-F. Bach, a danish retired engineer.

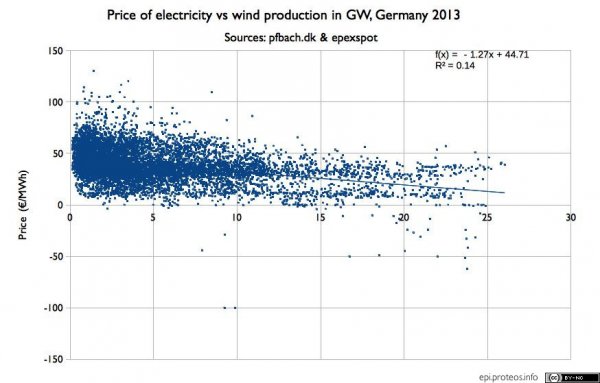

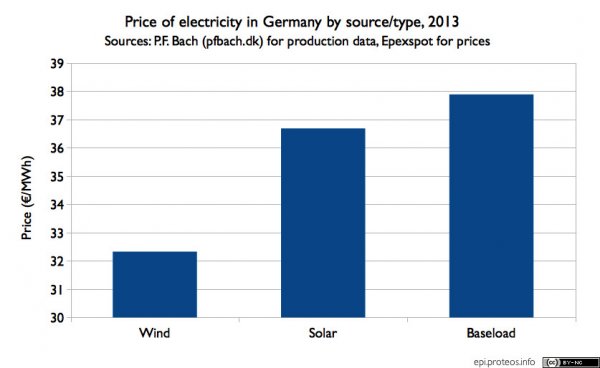

In Germany

The german market is in a situation of over supply because of the economic situation in Europe, of new coal plants — coal is now relatively cheap because of exports from the US and the shale gas boom there — and of the construction of more than 30GW of wind and 30GW of solar. As a consequence the baseload price is low. In 2012, it was about €43/MWh; in 2013 it was about €38/MWh. Wind power fetched an average of €37.5/MWh in 2012 and €32/MWh in 2013. Solar power got €44/MWh in 2012 but €37/MWh in 2013: the advantage for solar power of producing only during the day has been completely eroded by the large size of the capacity in Germany.

Trying to correlate wind production and the price leads to an estimate of the reduction of the spot price of €1.3/MWh per GW of wind production. However, the correlation is weak, because the price of electricity reflects many other constraints, such as total consumption.

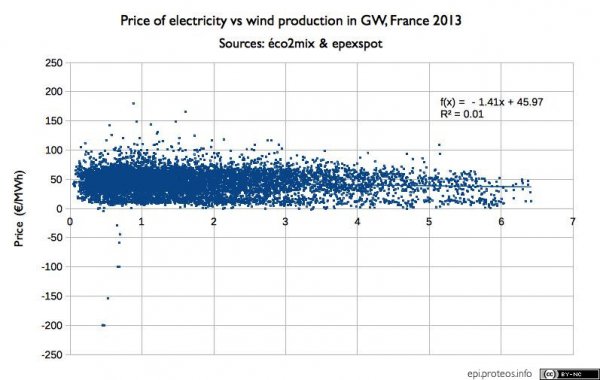

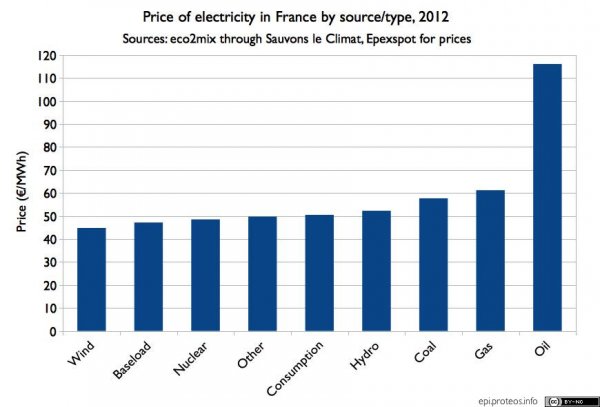

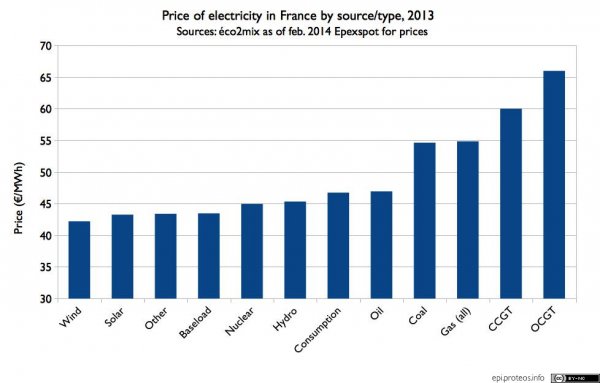

In France

France is in a market economic crisis now, which puts it also in a situation of average over supply. There are however worries regarding peak capacity as european directives such as LCP and IED are forcing old coal- and oil-fired plants to close. The baseload price is higher than in Germany. In 2012, it was about €47/MWh; in 2013 it was about €43.5/MWh. The wind price was €45/MWh in 2012 and €42/MWh in 2013. Up to 2013, there was no specific data for solar power. In 2013, solar fetched a price of €43/MWh.

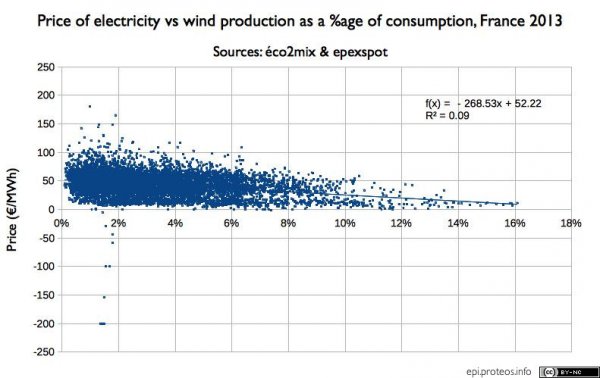

If we look at the correlation between the price and the wind production, we see same slope, yet the correlation is very weak, because there is much less wind capacity in France than in Germany. As a consequence, other factors tend to dwarf the effect of wind power most of the time. If we look at wind production as a share of consumption, the correlation becomes much clearer, yet other factors continue to play a major role.

What consequences?

With these two years of data, we can conclude that intermittent sources of electricity would fetch a price lower than the baseload price in an open market. The magnitude of the rebate depends on the installed capacity. The european wind power lobby tells us that there were 33.7GW of wind in Germany and 8.2GW in France at the end of 2013. Similarly, there was something like 36GW of solar in Germany and 4.3GW in France at end 2013. In Germany, wind represented 8.1% of the electricity production in 2012 and 8.4% in 2013; solar was at 4.2% (2012) and 4.7% (2013). In France, wind represented 2.8% of the production in 2012 and 2.9% in 2013; solar was at 0.7% and 0.8% respectively.

Despite such low figures, the rebate is already 15% in Germany for wind power. Thus, it is hard to imagine that wind and solar would come to dominate the electricity production in Germany without a long lasting system of subsidies. The more wind power increases its share, the more the price it fetches on the open market is far from the baseload price. In the case where wind power would represent 30% of the production in Germany, it could mean that wind power would only get around 50% of the baseload price. The system of subsidies is also feeding on itself: today, new capacity is built thanks to subsidies, but the more wind capacity there is, the more the subsidies are needed to allow the construction of new wind turbines to proceed. Reaching price parity with other technologies will not be the end of road for wind and solar: they need to become much cheaper than alternatives to survive on their own in an open market. Therefore, I think that the chances that the subsidies will end any time soon are very slim. On the contrary, it looks like these subsidies will become a permanent feature of the electricity market throughout Europe.

That does not mean in itself that such subsidies should not be granted. After all, if we are to phase out the use of fossil fuels in electricity generation, wind and solar are among the few technologies where capacity can be expanded without hitting a hard geographical limit right away. Yet, a fixed feed-in tariff does nothing to lower the price of a technology, on the contrary one may just choose to use this tariff as a given and not try to lower prices. Indeed, wind power tariffs have been steady in France for some years and the amount of new wind capacity connected to the grid each year is decreasing since 2009. The European Commission wants these fixed tariffs to be phased out by 2017, but it is unclear if this will result in price decreases: in France there has been competitive tenders for some technologies and it turned out that, in the end, prices were often higher than the fixed tariffs. This state of affairs was widely denounced in a public report last year.

Another issue is the intermittency of wind and solar means that other means of production have to be used to plug the gap between their production and the demand. For the foreseeable future, this is going to mean relying on dispatchable plants, such as hydro dams, nuclear plants and, of course, fossil fueled plants. These plants generally see their profitability eroded by the operation of wind and solar power as they run less hours and receive a lower price because of the zero marginal cost of wind and solar production. As it is unthinkable that black outs be allowed, it is likely that we will see the implementation of capacity markets throughout Europe. It turns out that the technology that allows the lowest investment for a given guaranteed dispatchable capacity is the open cycle gas turbine, a fossil fueled technology. In other words, it may well be that governments may command subsidies for wind and solar power in the name of fighting climate change, while at the same time the very same governments will enforce rules guaranteeing the cash flows of fossil fueled plants to ensure security of supply.

Finally, it does seem that the foundations of the electricity internal market are rotten: the low carbon means of production — be it nuclear or renewables — have their price essentially determined by their capital expenditures, whereas the majority of the costs for fossil fuel plant are fuel costs. Having costs determined primarily by the cost of fuel is useful when the market of reference is the spot market: it reduces the investment risk you take. If you have to invest huge sums of money in a machine that will last decades, you will want to have a guarantee on your cash flows to avoid losing your shirt in case events do not back your assumptions. That means low carbon means of production like long term contracts which are discouraged under current EU rules. For wind and solar, their intermittency makes them also less appealing for such long term contracts, as they can't guarantee at which time they are producing. That is why I think that subsidies for wind and solar will stay for a very long time, perhaps permanently, in one form or another.

Commentaires